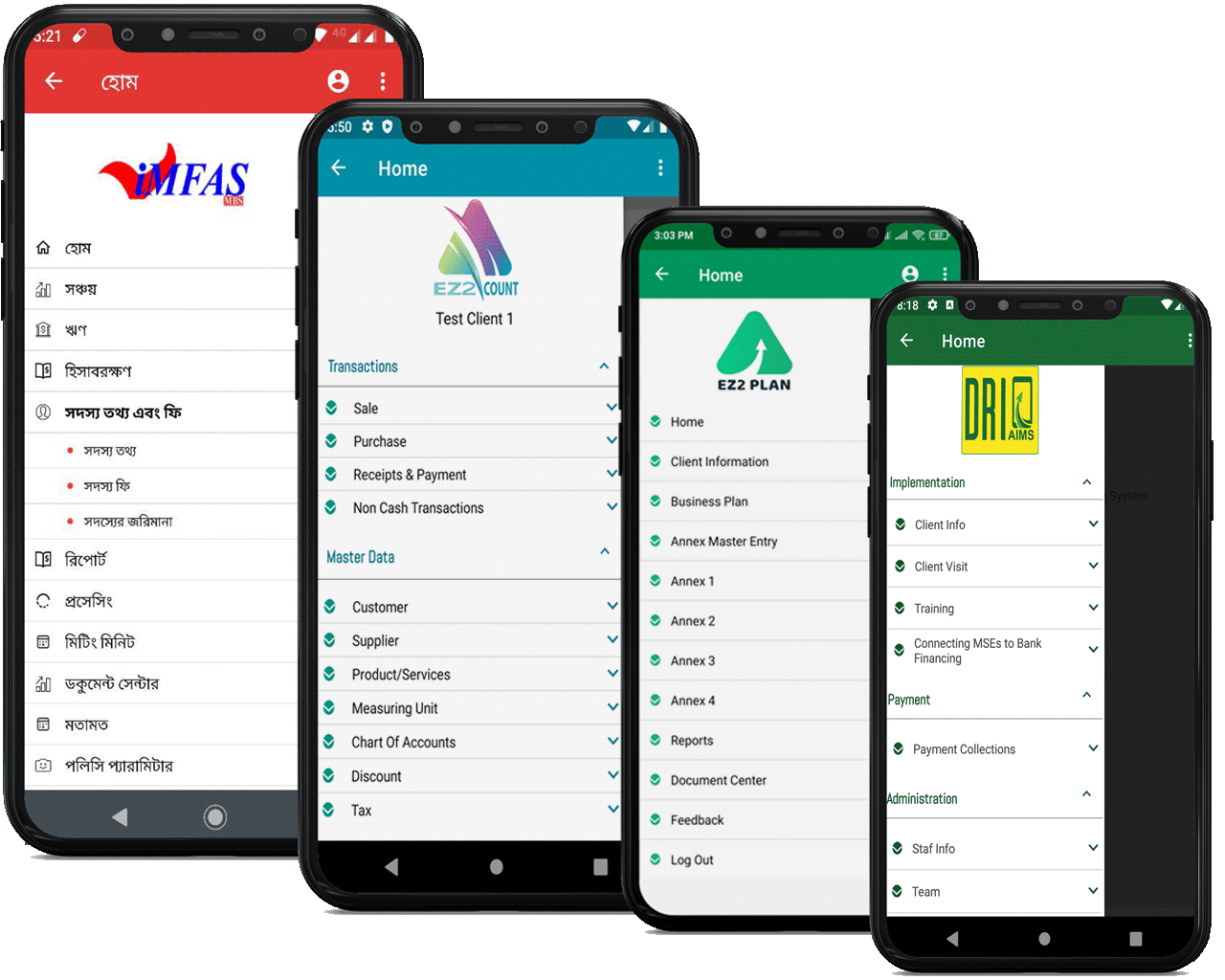

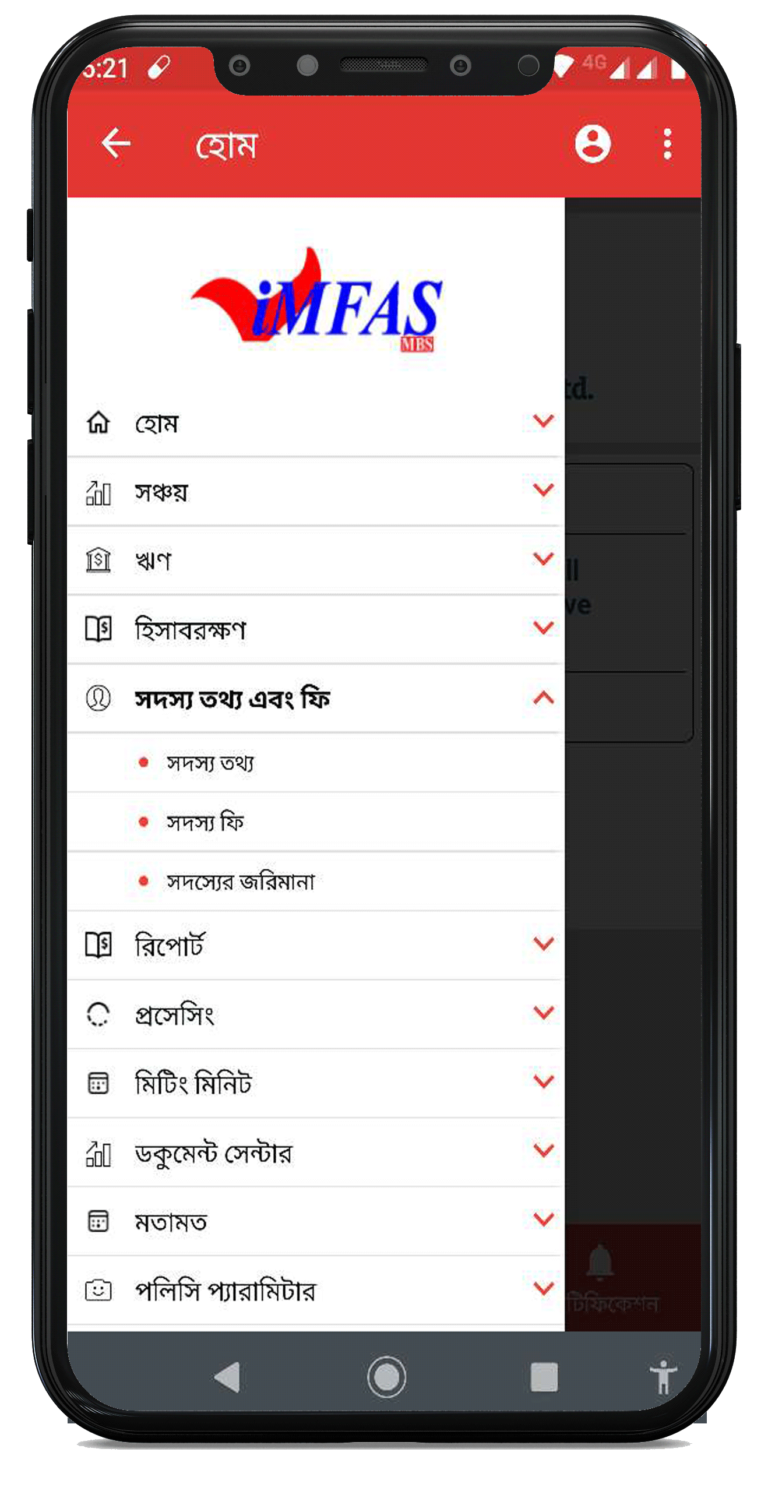

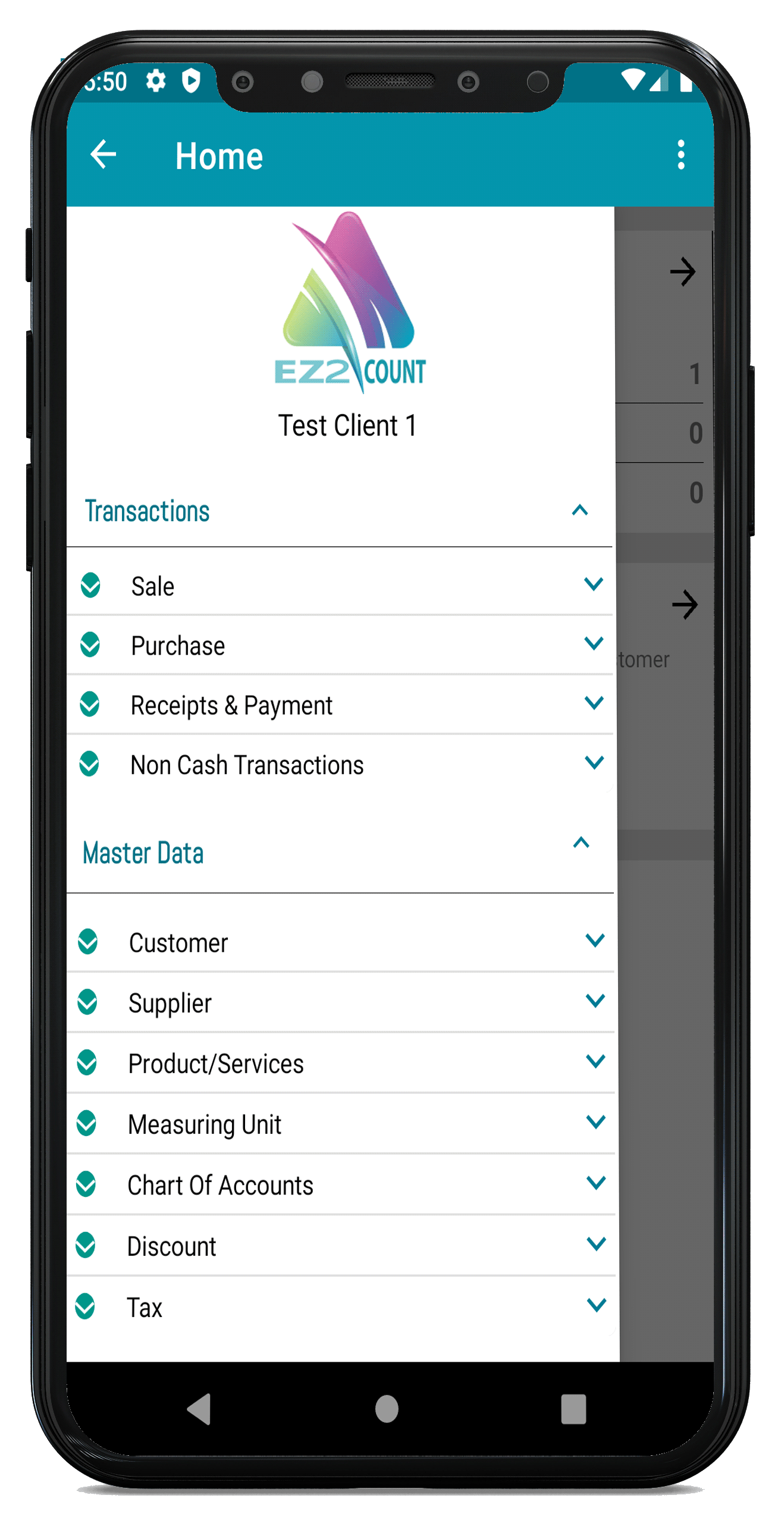

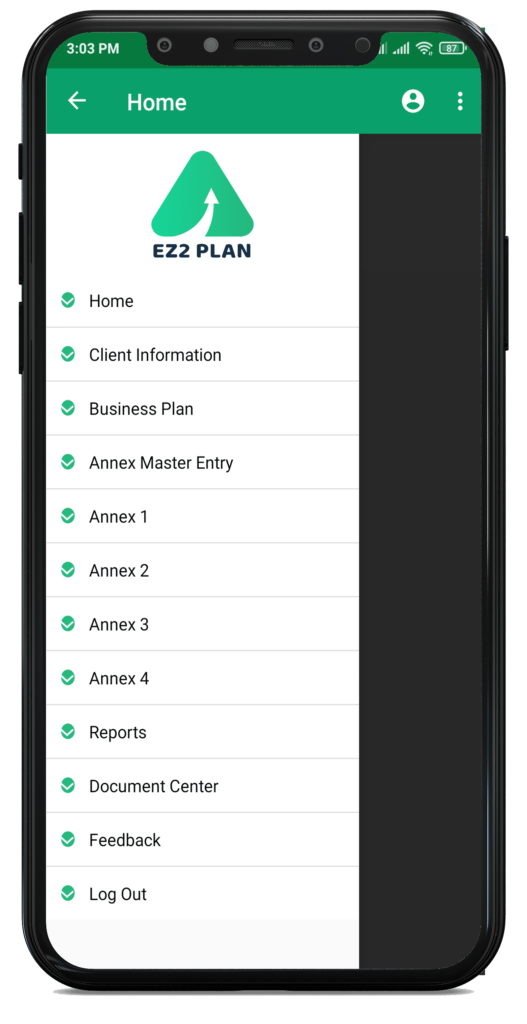

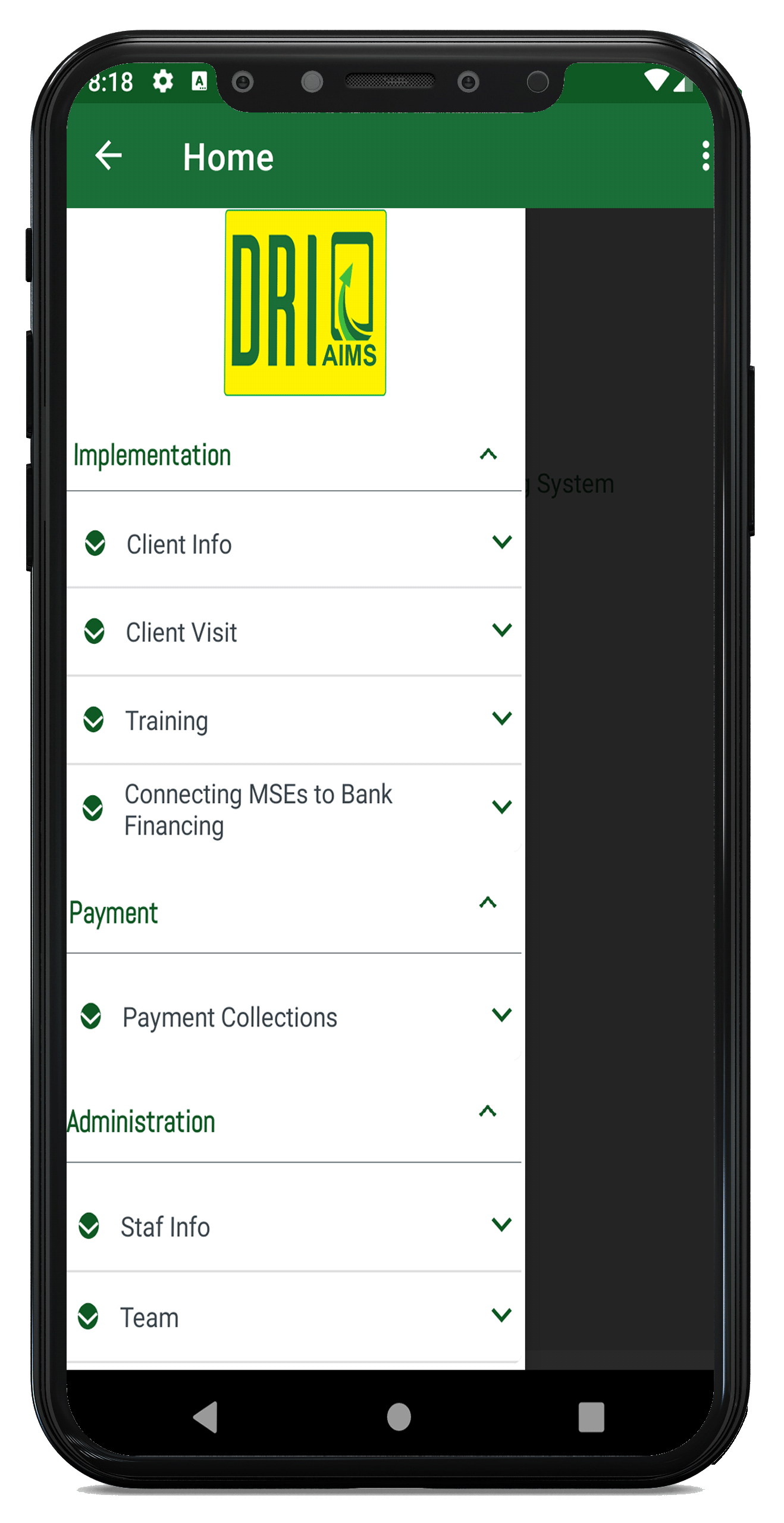

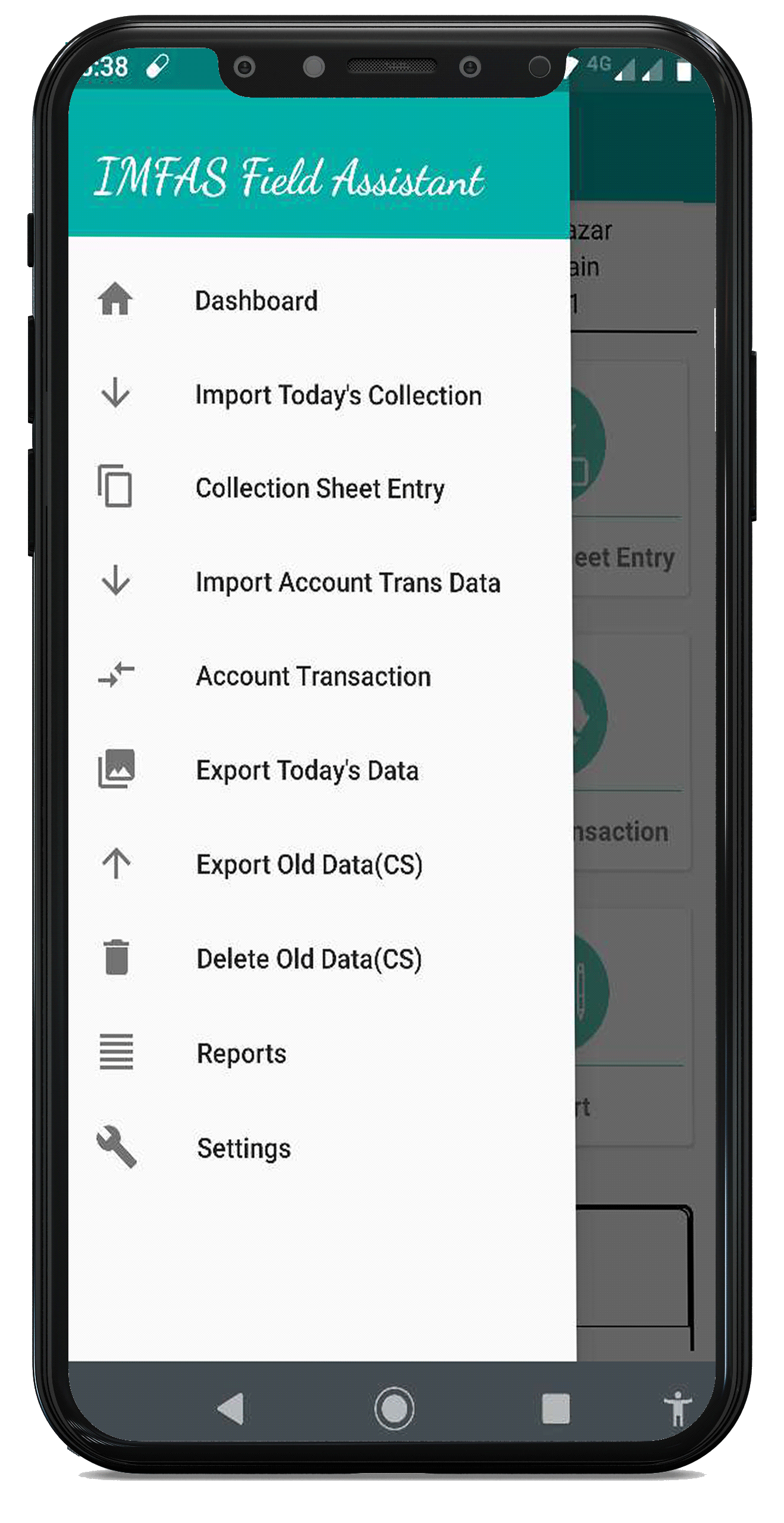

The iMFAS is the Flagship product of InitVent Consulting Services Ltd. This is an online-based comprehensive solution for large scale Micro Finance organizations across the globe. Using this all the micro banking operations like customer management, Savings Management, Loan Management, Personnel Management, Accounting Management, Branch/Unit Level Operations, Field assistants using android based handheld devices, Organization Level integration, Reporting, etc. can be performed very smoothly and efficiently. It’s a total solution for micro banking organizations. iMFAS Field Assistant System is a mobile client for iMFAS (Integrated Micro Finance Automation Suite) of InitVent Consulting Services Ltd. to collect customers Savings & Loan instalments from the Field – clients doorstep or meeting place. iMFAS is an online ERP for Micro Finance Institutions across the globe. This can work as an Online or Offline File-based mode. In the case of online using Restful Web Service, it communicates with the iMFAS service. In case of offline, it depends on the CSV file for collection data (Customers along with Savings & Loan Accounts ). This app has its own Database – SQLite. To start working on it one needs to import data first. When the collection is finished s/he needs to export the collected data. For working this import/export, the first one needs to do the settings for the data source, either File or Online. Otherwise, it will not work.

For getting demo settings (configuration/file) contact us at info@initvent.com.

Enjoy!